Carbon tax gradient icon.Tax levied on carbon goods and services.Economically profitable. Universal basic income.Isolated vector illustration.Suitable to banners,mobile apps and presentation Stock-vektor | Adobe Stock

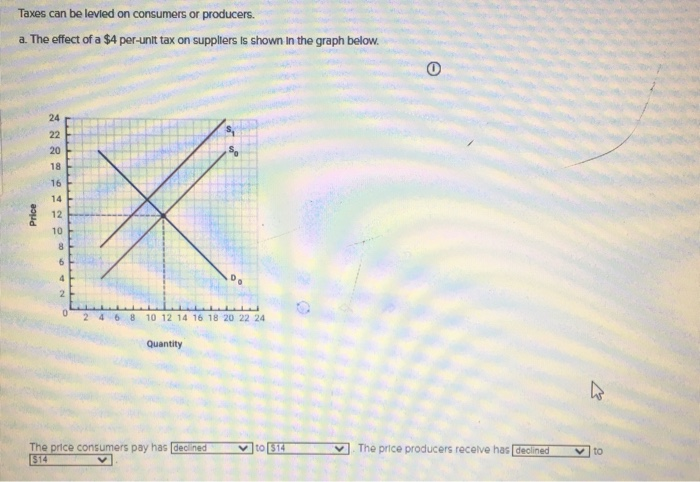

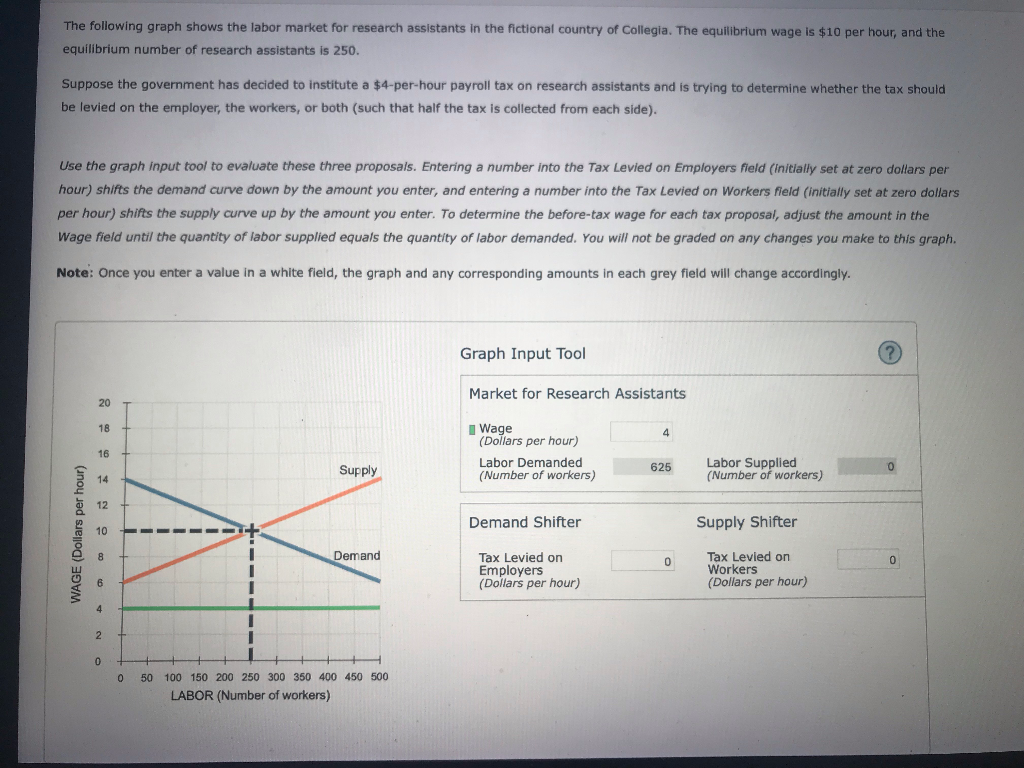

A tax levied on the buyers (demand side) of a product: A. Leads to a lower equilibrium B. Shifts the demand curve to the right C. Has no effect on the supply

Excise taxes blue concept icon. Legislated taxation on purchased goods idea thin line illustration. Tax levied on commodities and activities. Vector i Stock Vector Image & Art - Alamy

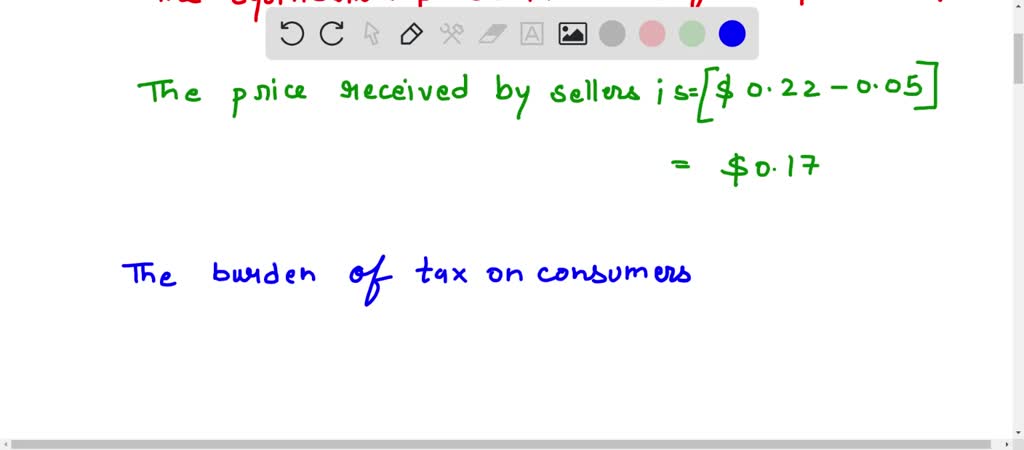

SOLVED: 3)Suppose a tax on beans of 0.05 per can is levied on firms. As a result of the tax, the equilibrium price increases from0.20 to 0.22. What fraction of the tax

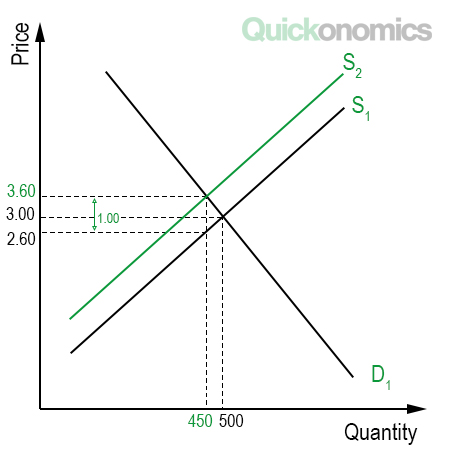

Using the mechanics of supply and demand, what does a tax do? How does it affect supply and demand and quantity in markets? | Homework.Study.com

:max_bytes(150000):strip_icc()/GoodsandServicesTax-36b9fbf71b1048a8ad617e0318af9c6b.jpg)